The 8-Minute Rule for Vancouver Tax Accounting Company

Wiki Article

The Only Guide to Small Business Accountant Vancouver

Table of ContentsThe 6-Second Trick For Vancouver Tax Accounting CompanyThe 9-Second Trick For Virtual Cfo In VancouverLittle Known Questions About Small Business Accounting Service In Vancouver.Fascination About Virtual Cfo In Vancouver8 Easy Facts About Outsourced Cfo Services ShownThe Definitive Guide for Cfo Company Vancouver

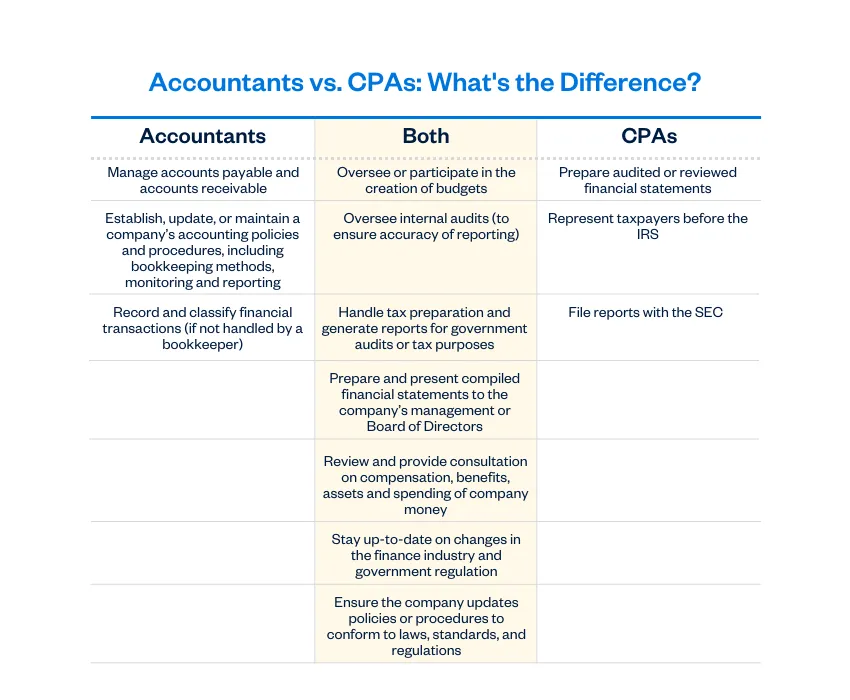

Right here are some advantages to hiring an accountant over an accountant: An accountant can give you an extensive sight of your organization's financial state, along with strategies and also recommendations for making financial decisions. Accountants are just accountable for videotaping financial purchases. Accounting professionals are needed to finish more schooling, certifications as well as job experience than bookkeepers.

It can be difficult to assess the appropriate time to employ an accounting expert or bookkeeper or to establish if you require one at all. While several local business work with an accounting professional as an expert, you have several alternatives for managing monetary tasks. Some little business proprietors do their own accounting on software program their accounting professional suggests or uses, providing it to the accounting professional on a regular, month-to-month or quarterly basis for action.

It might take some background study to find an appropriate accountant since, unlike accountants, they are not called for to hold a professional qualification. A solid endorsement from a trusted associate or years of experience are very important elements when hiring an accountant. Are you still not sure if you need to work with someone to aid with your publications? Below are three circumstances that indicate it's time to work with an economic expert: If your taxes have come to be as well complicated to handle on your very own, with several earnings streams, foreign financial investments, several deductions or various other factors to consider, it's time to employ an accounting professional.

Cfo Company Vancouver Fundamentals Explained

:max_bytes(150000):strip_icc()/GettyImages-1126511626-72ceb797e9664d05bcb2f7e0a8914b8b.jpg)

For local business, experienced cash money management is a crucial facet of survival and growth, so it's smart to deal with a monetary professional from the beginning. If you favor to go it alone, take into consideration starting out with accountancy software and keeping your books carefully up to date. That method, must you require to hire a professional down the line, they will have exposure right into the total economic background of your organization.

Some source meetings were conducted for a previous variation of this article.

Some Ideas on Vancouver Accounting Firm You Should Know

When it comes to the ins and outs of taxes, bookkeeping as well as financing, nonetheless, it never ever hurts to have a seasoned professional to rely on for support. An expanding variety of accountants are likewise caring for points such as money flow forecasts, invoicing and also HR. Inevitably, much of them are handling CFO-like duties.When it came to using for Covid-19-related governmental funding, our 2020 State of Small Business Research discovered that 73% of small organization proprietors with an accountant said their accountant's recommendations was very important in the application procedure. Accountants can also assist business proprietors avoid costly errors. A Clutch study of small company proprietors programs that more than one-third of small companies list unpredicted expenses as their top monetary difficulty, followed by the mixing of organization and personal financial resources and also the failure to receive settlements on time. Local business owners can expect their accounting professionals to help with: Picking the service structure that's right for you is very important. It impacts just how much you pay in taxes, the documentation you need to file as well as your personal liability. If you're wanting to convert to a various business framework, it might result in tax effects as well as other issues.

Also firms that are the same BC size as well as industry pay really various amounts for audit. Prior to we get right into dollar figures, let's discuss the expenses that go right into small company audit. Overhead costs are costs that do not straight become a profit. Though these costs do not exchange money, they are required for running your company.

The Best Guide To Small Business Accountant Vancouver

The typical cost of accountancy solutions for tiny service varies for each special circumstance. The typical monthly accounting fees for a tiny organization will rise as you include much more solutions and the jobs obtain more challenging.You can tape-record purchases as well as procedure pay-roll utilizing on-line software program. You go into amounts into the software application, and the program calculates totals for you. In some cases, payroll software application for accountants allows your accounting professional to supply pay-roll processing for you at really little added cost. Software solutions can be found in all forms and also dimensions.

The Ultimate Guide To Cfo Company Vancouver

If you're a new company owner, don't neglect to aspect bookkeeping costs right into your budget plan. If you're a veteran proprietor, it may be time to re-evaluate accountancy expenses. Administrative prices as well as accountant costs aren't the only audit expenditures. small business accountant Vancouver. You must additionally think about the impacts bookkeeping will certainly have on you and also your time.Your capability to lead staff members, serve clients, and also choose can suffer. Your time is likewise beneficial and ought to be taken into consideration when taking a look at bookkeeping prices. The moment spent on bookkeeping jobs does not generate revenue. The much less time you invest in bookkeeping and also tax obligations, the even more time you need to expand your company.

This is not planned as lawful advice; for additional information, please go here..

A Biased View of Tax Consultant Vancouver

Report this wiki page